Sunday, November 3, 2024

The Art of Field Research: Methods and Experience Sharing in Peking University's Value Investing Course

As Charlie Munger once said: "Value investing is primarily a practical discipline."

This article comes from a 2021 value investing course at Peking University's Guanghua School of Management. It features guidance and Q&A from Mr. Pan Yinjin, Managing Director at Himalaya Capital, who shares his practical experience on company research. The author discusses what preparation work needs to be done before, during and after field research, as well as important details and methods to pay attention to during the research process.

Why Conduct Field Research?

Even if you ran into Bill Gates on the streets of Seattle in 2009, he may not have had 100% knowledge of everything happening in Microsoft's operations - there are many real situations we need to uncover ourselves.

When choosing research targets, we need to weigh the return on investment and understand our own circle of competence.

We must show basic respect for our interview subjects and put ourselves in their shoes, while being fully aware of their position and perspective.

During the research process, our true identity should be that of students - like in Confucius' saying "Among three people walking, there must be one who can be my teacher."

Processing research materials requires daily logging and accumulation, and common sense that comes from time and experience.

Most importantly, although a single research trip may seem small, it can become the beginning of long-term in-depth research.

The main content follows below.

I'm delighted to have this opportunity to share and discuss my previous research experiences with everyone. Since many of our students are about to start their project research, which will likely involve investigating various aspects of a business, I'll focus today on sharing some key details and methods to keep in mind during the research process.

I'll break down the research preparation into three phases - before, during, and after the research - to explain what preparatory work needs to be done at each stage. But first, let's clarify the significance of field research.

The Significance of Field Research

In field research, the most crucial component is the interview process. This involves gathering necessary information and data from our research subjects through conversations and questioning.

Information collection usually involves two types: Primary Source(Original source) and Secondary Source, which are one-hand information and two-hand information. One-hand information includes company announcements, annual reports, etc., while two-hand information mainly consists of news and research reports, many of which are based on the one-hand information. However, these collected information may not be sufficient for a thorough study of a company. This is why we need to conduct field research.

Let me give you a simple example. If I ran into Bill Gates on the streets of Seattle in 2009, I could directly ask him about his sales expectations for Windows 7. As Microsoft's chairman at the time, Gates could explain using Windows' market share and penetration rates - what the penetration rate targets were, what the market share goals were, and therefore project what Windows 7's revenue and profits might look like by the end of that year.

However, even as a member of management or chairman of the company, he may not have had complete understanding of everything happening in the company's operations, including details about operations, competitors, distribution channels, upstream suppliers and downstream customers. So having 100% grasp of all information would have been difficult. For instance, he likely hadn't visited Chinese universities at the time. Although Windows 7 had high market share and penetration in 2009, a large portion of users were likely using pirated versions of the system - something he may not have fully understood. Of course we must respect copyright, this is just used as an example.

To truly understand a company's situation from top to bottom, field research is still necessary even with existing primary and secondary data and information - there are many real situations we need to uncover ourselves. This is why we're discussing the importance of conducting field research in this preparation course.

How to Conduct Effective Field Research

Part 01 / Preparation Before the Research

First, let's talk about the preparations we need to make before conducting field research.

Field research is a crucial part of the entire research process, and the opportunity to conduct it is often hard to come by. The subjects of your research might be introduced by friends, arranged by sellers, or even found with the help of your family, making these opportunities very valuable. Therefore, the preparation work before the research must be as thorough as possible.

There are two key points to note about your research subjects.

The first point is to know who your research subject is. Are they the company's management, the board office staff, industry experts, sell-side analysts, or any other person related to the company? Different people represent completely different perspectives, so everyone will view the company from their own position. It's like looking at an elephant; viewing it from the back, the legs, the waist, or the trunk will give you completely different perspectives. Only by piecing all this information together can you get a more comprehensive understanding of the company's situation.

The second important point is to clearly understand who helped you establish contact with the research subject before the research. In other words, the relationship between the person who helped you establish contact and the research subject determines the credibility of the information you receive. Not everyone you research will be willing to share all the information they have with you for free. For example, if the research subject happens to be your family member or relative, the information they provide is likely to be 100% reliable. Conversely, if the person who arranged the meeting is an enemy of the research subject, the subject might deliberately mislead you in many aspects, and the information provided may not be true at all.

Therefore, we need to know who helped us establish contact with the research subject, so we can determine the reliability of the information we receive. Regardless of who the person is or through what channels they helped us contact the research subject, we need to understand their stance and the credibility of the information they might share before the research. With this basic understanding, we should try to create a relaxed environment during the research process, allowing the subject to share information comfortably.

Secondly, think about what problem the research aims to solve.

Good research opportunities are hard to come by, so we must cherish them. Therefore, we need to prepare thoroughly for the specific problem we want to solve through the research. This requires detailed and meticulous homework on all publicly available information about the company before the research. The more prepared we are, the more effective the research will be.

The depth of information you hope to obtain from the subject during the research depends on the depth of the questions you ask. For example, if you ask someone who has a deep understanding of the company (say 9 out of 10) but your questions are only at a level of 1 or 2, the answers you get will likely be at a level of 2 or 3, just slightly better than your questions. However, if you can ask questions at a level of 8, they might be willing to share and discuss all the details they know because they see that you have a deep understanding of the company.

Therefore, the feedback you receive during the research depends on the quality of the questions you ask. Since the subject usually knows more about the company or certain aspects of it than we do, the more prepared we are, the more information we are likely to obtain.

Finally, we need to understand how the questions we ask can impact the value of the company. If our questions are too simple, we might find answers in existing annual reports, sell-side research reports, or news articles. If we only ask these types of questions, we miss out on a lot of the value that field research can provide, as we could have obtained much more information.

However, if we ask questions that are highly relevant and critical to the company's value, it is often difficult to get the true answers during the first or second round of research. This is because these questions are very important, and the interviewees themselves might need to research and explore the answers, and they might not trust you enough initially. In such cases, there is no need to rush. Build a good relationship with them, and you can gradually work together to find the answers to these questions.

This also involves how to position your questions during the research process.

Whether we are students now or future buy-side or sell-side researchers, fund managers, or private equity investors, in the actual research process, our true identity should be that of a student. As Confucius said, "Among any three people walking, I will find something to learn from." Our research subjects are certainly more experienced and knowledgeable in certain areas than we are, and learning from them is the real reason we conduct research. Therefore, during the research process, we should adopt a humble attitude, establish connections with a learning mindset, and seek advice from others. This will be very helpful for conducting effective research and for long-term tracking and studying specific areas.

Part 02 / Field Research Tips

First, consider how you ask your questions.

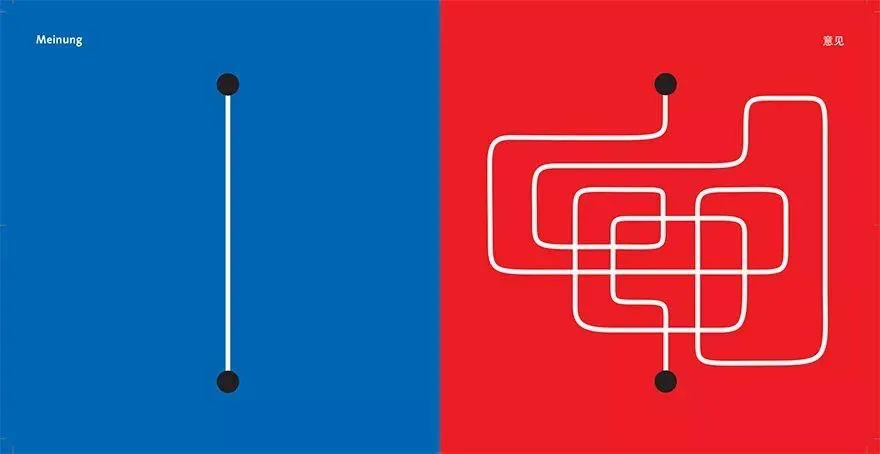

In my experience, there's no universal method for asking questions; it really depends on who you're talking to. For example, in Western cultures, people tend to be more direct, so you can ask straightforward questions. But in Eastern or Chinese cultures, it's better to be more subtle and tactful (as shown in the image below). Also, the way you ask questions can change based on the person's role. For example, the way you ask a channel distributor or agent will be different from how you ask company employees or executives. Some questions need to be more indirect, while others can be more direct. But no matter the approach, the key is to make the other person feel comfortable during the conversation, so they are more willing to share information with you.

Secondly, be prepared that one or two rounds of research may not yield all the answers.

As mentioned earlier, even after thorough preparation, the questions we ask during research are often not easy to answer and may not be found in publicly available information. Therefore, we must be mentally prepared that the first round of research may not provide clear answers. This is something we need to be aware of. During the research process, if the interviewee is unwilling to answer your questions, you can push them for an answer, but the reliability of the answer may be questionable.

Regardless of how we establish contact with the research subject, their willingness to share knowledge or information with us is a favor, not an obligation. So, we must manage our expectations: we may not get the answers we want through just one or two rounds of research.

However, over one or two rounds or more, we can build greater trust with the research subject. Just like becoming friends over time, trust is built gradually. Only with mutual trust can we learn more during the exchange, and the interviewee will be more willing to share what they truly know.

Third, pay attention to details and show respect to your interviewees.

During the research process, it's important to observe basic etiquette. For example, if you have scheduled a time for the interview, don't be late. During the interview, don't interrupt the session to take a phone call or handle other personal matters. The interview is a time you have arranged with the interviewee, and showing respect for their time is fundamental. Only by respecting them can you earn their respect in return.

Additionally, there are other details to consider. When conducting research, especially with more experienced interviewees, think about what method of recording they might be more comfortable with. For instance, should you use a mobile phone to take notes, a laptop, or a paper notebook? Generally, if the interviewee is a manager or employee of a state-owned enterprise, they might be more sensitive to these aspects.

The last and most important point is empathy, which can be translated as "putting yourself in someone else's shoes." This means considering whether the actions you take would make the other person feel comfortable if you were in their position, which in turn makes them more willing to share information with you. For example, during a quiet period or close to it, the interviewee might be in a sensitive time frame. If you still approach the company's board office for performance guidance, you need to consider whether it would be appropriate or if it might be seen as a violation, and whether it's the right time for them to accept your research.

For example, if you are researching a bank branch or a consumer goods channel, and there is no trust established, the first time you visit, they might suspect you are sent by a competitor or by the head office for an internal check, and sharing information with you might cause them trouble. At this point, you need to put yourself in their shoes and think about how to make them feel comfortable, gradually building a genuine and long-term trust relationship. Regardless of their position, whether they are the chairman, an executive, a regular employee, a distributor in the channel, a competitor, or an ordinary customer, you should always show respect. Only by respecting them can you gain more trust and obtain more and possibly better information during your research.

Part 03 / Things to Note After Research

Finally, let's briefly discuss some things to note after completing your research.

First and foremost, continue to show respect to your interviewees. If possible, treat them more like friends rather than just a paid, one-time consultation source. Personally, I believe this is the minimum level of respect you should show.

Secondly, after completing the research, it's important to maintain at least some level of contact with the interviewee. Many issues you aim to resolve through research may not be fully addressed in one or two sessions, especially if you haven't yet earned the interviewee's complete trust. Once trust is established, even if the interviewee doesn't know the answer to your question, they might introduce you to someone who does. As long as they trust you and have credibility with the person they refer you to, the person who can truly solve your problem or knows the answer will be more willing to share with you.

It's like when you first start researching an industry or field, your knowledge and contacts are limited. But as you gradually build trust with your research subjects, your network expands. For example, if you're researching the liquor or home appliance industry, you might initially only contact one or two distributors. Over a year or two, you may find that many people in the industry trust you. As long as you position yourself correctly and operate within legal boundaries, trust will build over time.

Thirdly, within your capabilities, be willing to share and help the interviewee when they need it. The term "interview" implies an exchange of views. After researching a company or industry for a long time, you may become an expert in that field. Your insights might be deeper than many others. For instance, if you've researched distributors in various regions, you can share your findings with them, based on publicly available information. This can help them in their business and enhance their understanding of the company.

Whenever someone provides you with information, be willing to share your knowledge when they need it. This mutual exchange builds trust and communication channels. This approach helps deepen research relationships and gather comprehensive information from various sources, whether they are management, competitors, customers, or channel personnel. Only by combining information from all these positions can you get a complete and accurate picture of the company's current situation.

Finally, let's discuss the importance of long-term tracking and follow-up.

Researching a company isn't a one-time task, even if it's just a class project. Many of you will likely work in investment in the future, doing similar work. My advice is to clarify your understanding of the research subject from the beginning and engage in long-term activities. Even if this is just a small research project, it's the starting point for studying this field. Gradually, you'll learn how to gain trust and do the right things, building your circle of competence.

In any industry you research, building a network or making friends can be valuable. When you need to understand the real situation, people will trust you and share information about channels, suppliers, and commodities. Doing long-term work is crucial.

In China, relationships are more networked rather than linear. For example, people often sit at round tables for meals, which is less common in the West. You never know who your research subject might know. The key is to do the right things from the start, approach others with humility, and gradually earn trust. This makes future research easier, regardless of the industry. This is based on my personal experience over the years.

Of course, companies are constantly evolving. But only by combining our current understanding of management, channels, and financial health can we gradually develop reasonable expectations for a company's future development.

This brings us to the importance of long-term tracking and follow-up.

Researching a company isn't just a one-off task, even if it's only for a class project. Many of you will likely work in investment in the future, doing similar work. My advice is to start with a clear understanding of your research subjects and approach it as a long-term commitment. Even if this is just a small research project, it's your starting point for studying this field. From here, you'll gradually learn how to earn people's trust, do things the right way, and slowly build your circle of competence.

In any industry you research, building a network and making friends can be incredibly valuable. When you need to understand what's really going on, people will trust you and be willing to tell you about distribution channels, suppliers, and what's actually happening with commodities. That's why taking a long-term approach is so important.

Especially in China, relationships are more like a web than a straight line. For example, in China we often eat at round tables, which isn't as common in the West. You never know who your research subject might be connected to. But one thing is certain - if you do the right things from the start, stay humble, and approach others as a learner seeking guidance, gradually building trust, your future research will become easier, no matter which industry you're studying. This is something I've learned from years of experience.

Summary and Review

First, before conducting research, we should do thorough preparation work to gain sufficient understanding of both the company and our research subjects. The more information we have beforehand, the more valuable insights we can gain during the research.

Second, regardless of who our research subject is or what level they're at, we need to maintain the right mindset - approaching everyone with a learner's attitude, ready to communicate and seek guidance.

Third, focus on building long-term relationships based on trust. If you start with this approach from the beginning, after a few years of research, you'll find that your knowledge and humble attitude will help you gain people's trust exponentially during interactions. This trust grows over time and becomes increasingly valuable. Don't pressure people for immediate answers or force solutions to problems.

Finally, I want to emphasize once more - always stay compliant with regulations. This is absolutely crucial, especially for those planning to work in investment-related fields. Only by ensuring compliance in every detail from the very start can you build a sustainable, long-term career.

Compliance covers many aspects. For example, you can't ask the board office for guidance during certain time periods, or use the information you obtain for non-compliant activities. Many of you have likely taken the CFA exam and are familiar with these principles, so I won't go into detail. I just hope everyone can build a solid foundation from the start - whether for this course or your future career - so that through your research process, you can learn what you want to know, gradually expand your circle of competence, and do excellent research and project work.

Related articles